Construction equipment depreciation calculator

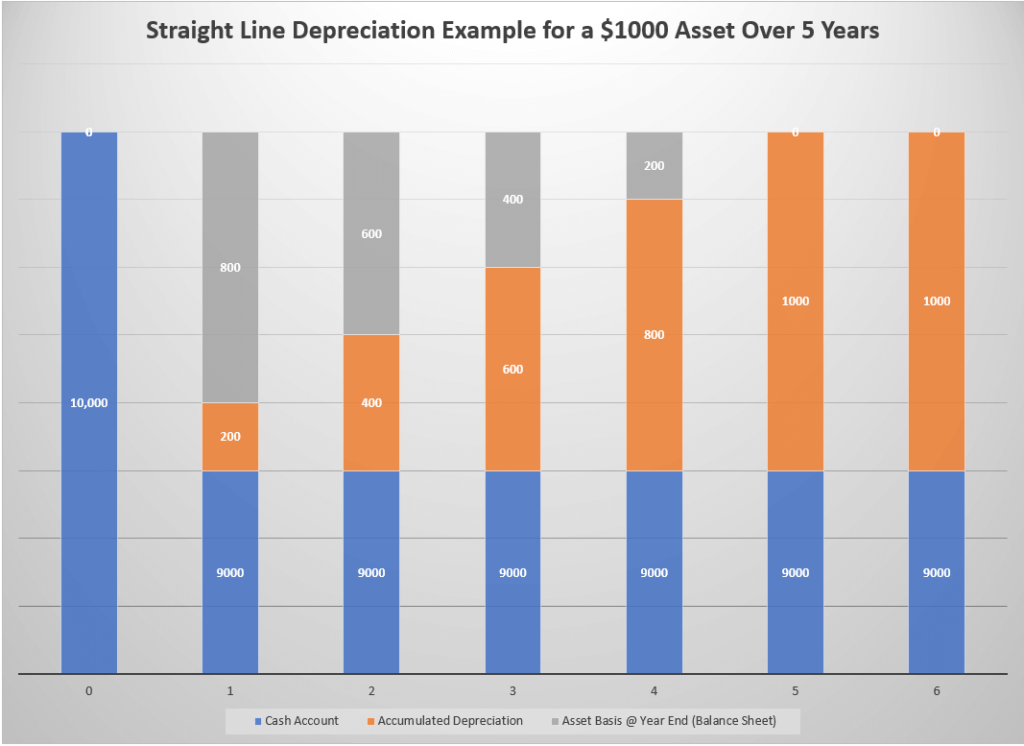

The calculator should be used as a general guide only. The straight line calculation as the name suggests is a straight line drop in asset value.

Depreciation Schedule Formula And Calculator Excel Template

To calculate the SYD use the following formula.

. This may seem obvious but its important to not skip any portion of the important information surrounding equipment use cost calculations. Also includes a specialized real estate property calculator. Up to 24 cash back The purchase of construction equipment requires a significant investment of money.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Ad Submit accurate estimates up to 10x faster with Houzz Pro takeoff software. Multiply the total cost of a piece of equipment x 5month x 13 x 80 to arrive at the estimated annual rental dollars.

Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. This means that we will get a depreciation value of 1716 per month by dividing the sale price 103000 by the remaining useful life 60 months. There are many variables which can affect an items life expectancy that should be taken into.

Facility equipment wont last forever so its important for facility managers to determine the average number of years an asset will be useful before its value is fully depreciated. This money either be borrowed from a lender or it will be taken. This paper analyzes methods of depreciation expenses calculation as well as their impact on the overall expanses of construction machinery and the impact on the cost per.

The depreciation of an asset is spread evenly across the life. Depreciation remaining asset lifetime SYD x cost value salvage value Bear in mind that the SYD value is the sum of all useful life. The Hourly Depreciation is the depreciation cost in respect of new machines chargeable to the work on hourly basis is calculated using Hourly depreciation 09 Book Value Life SpanTo.

Builders save time and money by estimating with Houzz Pro takeoff software. We do work we put completed. We understand the importance of accuracy and timeliness with your business and tax needs and we make certain that you can rely on us to get the job done.

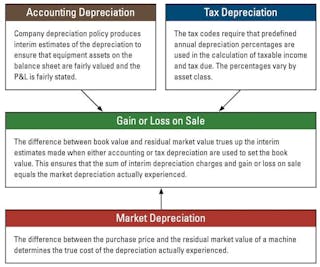

You must add otherwise allowable depreciation on the equipment during the period of construction to the basis of your improvements. Lets turn to the diagram and develop a simple pragmatic understanding of a how depreciation works. Equipment used to build capital improvements.

There are a couple. Box 1 shows the beginning of the cycle. Depreciation Cost of Construction Equipment.

Depreciation represents the decline in the market value of a piece of equipment due to age wear deterioration and obsolescence. Following is an example.

Depreciation Formula Examples With Excel Template

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Safety Checklist Examples Safety Checklist For Office Construction Safety Checklist Excel Building S Safety Checklist Checklist Template Fire Safety Checklist

What Is Equipment Depreciation And How To Calculate It

Depreciation Formula Calculate Depreciation Expense

What Is Equipment Depreciation And How To Calculate It

Product Pricing Calculator Pricing Calculator Sample Resume Spreadsheet

This Balance Sheet Template Allows Year Over Year Comparison Including Accumulated Depreciation Balance Sheet Template Balance Sheet Cash Flow Statement

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Of Building Definition Examples How To Calculate

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Overview How It Works Example

Three Types Of Asset Depreciation Construction Equipment